All about YIELD App - DeFi Banking In Your Pocket

Crypto.com DeFi Wallet - Securely Store and Earn from Your Digital Assets

Our Top DeFi Coins by Market Capitalization - CoinGecko PDFs

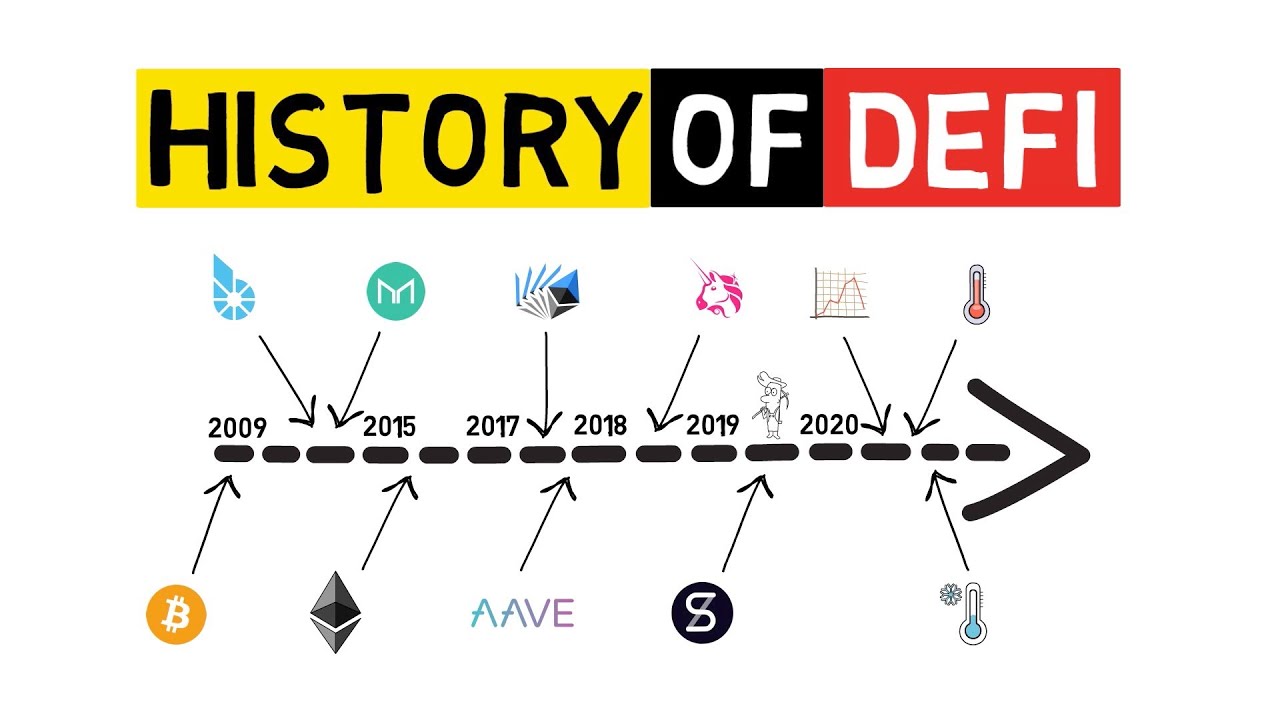

Financial services without any main authority. Generally open-source, permissionless and blockchain based Decentralized financing (typically referred to as De, Fi) is a blockchain-based type of financing that does not depend on main monetary intermediaries such as brokerages, exchanges, or banks to provide conventional financial instruments, and rather makes use of smart agreements on blockchains, the most typical being Ethereum.

De, Fi utilizes a layered architecture and extremely composable foundation. Some De, Fi applications promote high rate of interest but undergo high danger. By October 2020, over $11 billion (worth in cryptocurrency) was deposited in various decentralized finance procedures, which represented more than a tenfold development during the course of 2020.

Analyst says DeFi and stablecoins held up well as crypto markets imploded

5 billion was bought De, Fi. History [modify] The stablecoin-based loaning platform, Maker, DAO, is credited with being the first De, Fi application to receive significant usage. It permits users to obtain Dai, the platform's native token pegged to the United States dollar. Through a set of smart contracts on the Ethereum blockchain, which govern the loan, payment, and liquidation processes, Maker, DAO intends to maintain the steady worth of Dai in a decentralized and self-governing manner.

Crypto.com DeFi Wallet - Securely Store and Earn from Your Digital Assets

Other platforms did the same, releasing the phenomenon referred to as "yield farming" or "liquidity mining," where speculators actively move cryptocurrency assets in between different pools in a platform and in between various platforms to maximize their total yield, that includes not only interest and fees however also the value of extra tokens got as rewards.

The Greatest Guide To Top DeFi (By Market Cap) - ADVFN

In September 2020, Bloomberg said that De, Fi made up two-thirds of the cryptocurrency market in terms of cost changes which De, Fi collateral levels had actually reached $9 billion. Ethereum saw a rise in developers during 2020 due to the increased interest in De, Fi. crypto, crypto currency, Blockchain , Alts, altcoin, cryptocurrency , bitcoin , dApp , fork , Mining , Hardware wallet , Moon, crypto market cap, crypto prices, crypto wallet, best crypto wallet, crypto mining, ada crypto, best crypto exchange,crypto apex, gemini crypto, robinhood crypto, crypto reddit, defi crypto, , Fi has attracted large cryptocurrency investor such as Andreessen Horowitz, Bain Capital Ventures and Michael Novogratz.

Instead of deals being made through a central intermediary such as a cryptocurrency exchange or a traditional securities exchange on Wall Street, deals are straight made in between participants, mediated by smart agreement programs. These wise agreement programs, or De, Fi procedures, generally run using open-source software application that is built and kept by a community of designers.